Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 21, no. 519: February 23, 1878

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

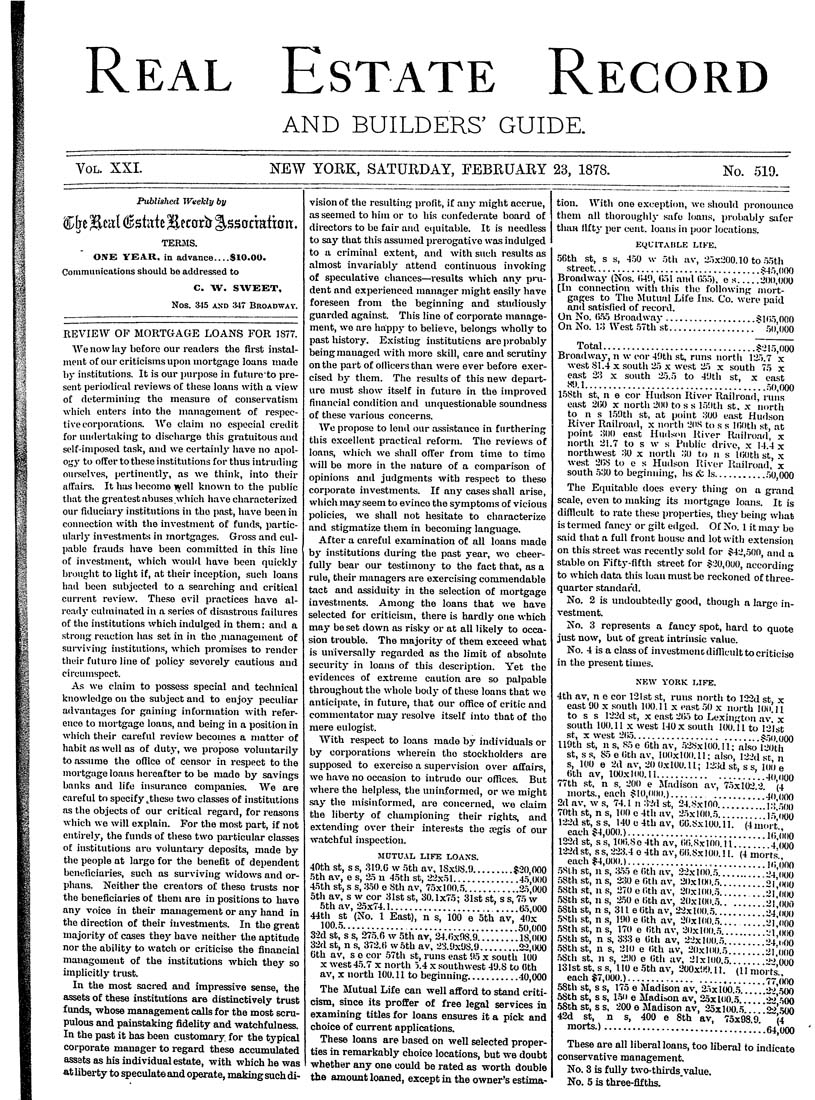

Real Estate Record AND BUILDERS' GUIDE. Vol. XXI. NEW YORK, SATURDAY, FEBRUARY 23, 1878. No. 519. '"") hi Published Weekly by TER3IS. ONE YEA.R, in advance....SIO.OO. Communications should be addressed to C. W. SWEET, Nos. 345 AND ;i47 Broadway. REVIEW OF MORTGAGE LOANS FOR 1877. We now lay before our readers the first in.stal- meut of our criticisms upon mortgage loans made bj- institutions. It is our purpose in futureto pre¬ sent periodical reviews of those loans with a view of deterniiniu.c: the metisure of conservatism which enters into the iiianagemeut of respec¬ tive corporations. Wo claim no especial credit for undertaking to discharge this gratuitous and self-imposed ta.sk, and we certainlj- have no apol- ogj- to offer to these institutions for thus intruding oui-selves, pertinently, as w-e think, into their alTaii-s. It has become lyell known to the public tluit the greatest abuses .which have characterized our fiduciary institutions in the past, have been in connection with the investment of funds, partic- uhirlj- investments in mortgages. Gross and cul¬ pable frauds have been committed in this line of investment, which would have been quicklj' broiight to light if, at their inception, such loans had been subjected to a searching and critical cut-rent review. These evil practices have al¬ readj- cultuitiated in a series of disastrous failures of the institutions which indulged in them; and a sti-oiig reaction has set in iu tho .management o£ sui-vivuig institutions, which promises to render their futuro line of policy severely cautious aud circumspect. As we claim to possess special and technical knowledge on the subject and to enjoy peculiar advantages for gaining information with refer¬ ence to mortgage loans, and being in a position in which their careful review becomes a matter of habit as well as of duty, we pt-oposo voluntarily to as.sume the ofilce of censor in respect to the mortgage loans hereafter to be mado by savings banks and life insurance companies. We are careful to specify ^tliese two classes of institutions as the objects of our critical regard, for reasons which we will explain. For the most part, if not entirely, the funds of these two pai-ticular classes of institutions are voluntary deposits, made by- the people at largo for the benefit of dependent beneficiaries, such as surviving widows and or¬ phans. Neither the creators of these trusts nor the beneficiaries of them are in positions to have any voice in their management or any hand in the direction of their investments. In tho great majority of cases they have neither the aptitude nor the ability to watch or criticise the financial mauagomeut of the institutions which they so implicitly trust In the most sacred and impressive sense, the assets of these institutions are distinctively trust funds, whose management calls for the most scru¬ pulous and painstaking fidelity and watchfulness. In the past it has been customary, for the typicfd corporate manager to regard these accumulated assets as his individual estate, -with which he was at liberty to speculate and operate, making such di¬ vision of the resulting profit, if anj- might accrue, as seemed to him or to his confederate board of directors to be fair and eipiitable. It is needless to say that this assumed prerogative was indulged to a criminal extent, and with such results as valmost invariably attend continuous invoking of speculative chances—results which any p»-u- dent and experienced manager might easilj"- have foreseen from the beginning and studiously guarded against. This line of corporate manage¬ ment, we are happj- to believe, belongs wholly to past history. Existing institutions are probably beingmauaged with more skill, care and scratiny on the part of ollicersthan were ever before exer¬ cised by them. The results of this new depai-t- ure must show- itself in future in the improved financial condition and unquestionable soundness of these various concerns. We propose to lend our a.ssistance in furthering this excellent practical reform. Tho reviews of loans, which we shall offer from time to time will be more in the nature of a comparison of opinions and judgments with respect to these corporate investments. If any cases shall arise, which may .seem to evince the symptoms of vicious policies, w-e shall not hesitate to characterize and stigmatize them in becoming language. After a careful examination of all loans made bj- institutions during the past year, wo cheer¬ fully bear our testimonj^ to the fact that, as a rule, their managers are exercising commendable tact and assiduitj- in the selection of mortgage investments. Among the loans that we have selected for criticism, there is hardly one which may beset down as risky or at all likely to occa¬ sion trouble. The majority of them exceed what is universally regarded as tho limit of absolute securitj- in loans of this description. Yet the evidences of extreme caution are so palpable throughout the whole body of these loans that w-o anticipate, in futuro, that our office of critic and commentator may resolve itself into that of tho mere eulogist. With re.spect to loans made by individuals or by corporations wherein tho stockholders are supposed to exercise a supervision over affairs, we have no occasion to intrude our oflices. But where the helples.s, the uninformed, or we might say the misinformed, are concerned, we claim the liberty of championing their rights, and extending over their interests the a^gis of our watchful inspection. MUTUAL LIFE LOANS. 40th st, s s, .319.0 w .5th av, lS.xaS.9.........$20 000 .5th av, e s, 25 n 45th st, '2-2x51..............4.5* (K)0 45th st, s s, :i50 e Sth av, 75x100.5...........25 000 5th av, s w cor 3Ist st, 30.1x75; Slst st, s s, 75 w .5th av, 2.5.X74.I...........................(i.5,o00 44tli st (No. 1 East), n s, 100 e 5th av, 4()x „ 1,00,5.....................................50,000 3-2d st, s s, 275,6 w Sth av, 24,15x98,9.........18 000 32dst, ns, 372,(5 %v.5thav. 2'3,9x9S.9.........22]000 Cth av, s e cor .57th st, runs east 95 x soutii 100 X west 45,7 x north 5,4 x ,southwest 49,8 to Oth av, X north 100.11 to beginning...........-40,000 The Mutual Life can well afford to stand criti¬ cism, since its proffer of free legal services in examining titles for loans ensures it a pick and choice of current applications. These loans are based on well selected proper¬ ties in remarkably choice locations, but we doubt whether any one could be rated as worth double the amoimt loaned, except in the owner's estima¬ tion. With one exception, we should pronounce them all thoroughly safe loans, probably stifer than fifty per cent, loans in poor locations. EyUlTABLE LIKE. 56th .st, s s, 4.50 w 5th av, 2.")x200.10 to 5.5th ^street....................................^145,(100 Broadway (Nos. (149, 0.~d and (555), e s.....200,000 [In connection with this the following mort¬ gages to The Mutual Life Ins. Co. were paid and satisfied of record. On No. (5.55 Broadwaj-...................j^p;.-, oflO On No. i:> West .57th st..................' 5()',000 „ Total.................................S-21,5,000 Broadway, n w cor 49th st, runs nortii 125,7 x west 81,4 X south 25 X west 25 x south 75 x ea-st 2;^ X .south 25.5 to 49th st, x cas't /'''''■ 1......................................50,000 155>th st, n e cor Hudson River Railroarl, runs etust 2(50 X nortii 200 to s s 150th st, x north to n s 159th st, at point '.iOO east Hudson River Railroiul, x north 2(IS to s s l(50th st at point oDO east Hudson River Rtiilro.ad x north 21.7 to s w s Public drive, x 1-1.4 x northwest 30 x nortii 30 to n s UiOth st .x west 2(58 to e s Hudson River Railroad,' x south .530 to beginning, hs & Is............50 000 The Equitable does every thing on a grand scale, even to making its mortgage lotins. It is difficult to rate these properties, tliej^ being w-hat is termed fancy or gilt edged. Of No. 1 it may bo said that a full front house and lot with extension on this street w-as recentlj- sold for $42,.500, and a stable on Fifty-fifth .street for .§20,000, according to which data this loan must be reckoned of three- quarter standard. No, 2 is undoubtedlj' good, though a largo in¬ vestment. No. 3 represents a fancy spot, hard to quote just now, but of great intrinsic value. No. -1 is a class of investnienc diflicult to criticise in the present times. NEW YORK LIFE. 4th av, n e cor 121st st, runs north to 12-2d st x east 90 x south 100.11 x etist 50 x north lOii'Tl to s s P22d .st, X east 215.5 to Lexington av x south 100.11 X west 140 x south 100.11 to I2"lst st, X w-est 2(55........................ s.^jo oOO 119th st, ns, a5e (1th av, .52.Sxl00.ll; also i"2oih st, ss, 85e(5tbav, 100x100.11; also 12-'d .st n s, 100 e 2d av, 20 0x100.11; I2.-{d.stss, io() e Oth av, 100x100.1 i.....................40 OOO 77th st, n s, 200 e JLidison av, 7.5x102 2 (4 morts., each -?10,oii().)....... ...... ' '.jo ooo 2d av, w s, 74.1 n 3-2d st, 24..8x100.. .*.".".'.'''' i:j'-,o() 70th st, n s, IOO e 4th av, '25x100..5....... l.VooO l-2-2dst, ss, 140o4thav, (JC.8xI(J0.1L (-1 inort each §4,000.).......................... i,;Vioo 122d st, s s, l()(5.8o 4th av, (1(5.8x100 11 ' 4'(k)0 l'2'2d st, s s, •2'23.4 e 4th av, (ili.Sx 100.11. (4"liiorts each |;4,0(M).).................,....._\ „V -,^1^, .58lh st, n s, a55 e Oth av, 2-2x100.5 ' -m'ooo ,58th st, n s, -230 e (5tli av, 20xI0()..5.. .......'^I'ooo .58th .st, 11 .s, 270 e (5th ax, 20xl()0..5.....'.""' *>!'ooo .5Sth st, n s, 2.50 e Oth av, 20xlO(),.5,, "" ~>U){H} 58th st, n s, 311 e Oth av, 22xl00..5___.'......•'4'ooo .58th st, n s, 190 e Oth av, 2()xl00..5.. ''I'dOO .5.8th st, n s, 170 e (ith av, '20xl00..5... -'I'ooo .5Sth st, n s, 333 e Gth av, 2-2xI0()..5___.....'~'4'ii00 .58th st, n s, 210 e (5th av, 20x100.5 "^rooo .5Sth st n s, 290 e Oth av, 21x100 5 *" •''>'ooO 131st st s .s 110 e Sth av, 200.x99.11. ' Yll niorrs.. each$<,000.)......................___ 77 (m 58th st, ss, 175 e Madison av, 25xIo6..5......'2'2'.500 SSth st, s s, 1.50 e Madison av, 2.5xIO0.i>..... '2*2'500 .5Sth st, s s, 200 e Madison av, 25x100 .5 ^>'500 43d st, n s, 400 e Sth av, 75x98.9"*~'(4 ^o'^-)..................................64,000 These are all liberal loans, too liberal to indicate conservative management. No. 8 is fully two-thii-ds.value. No. 5 is three-fifths.