Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 24, no. 609: November 15, 1879

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

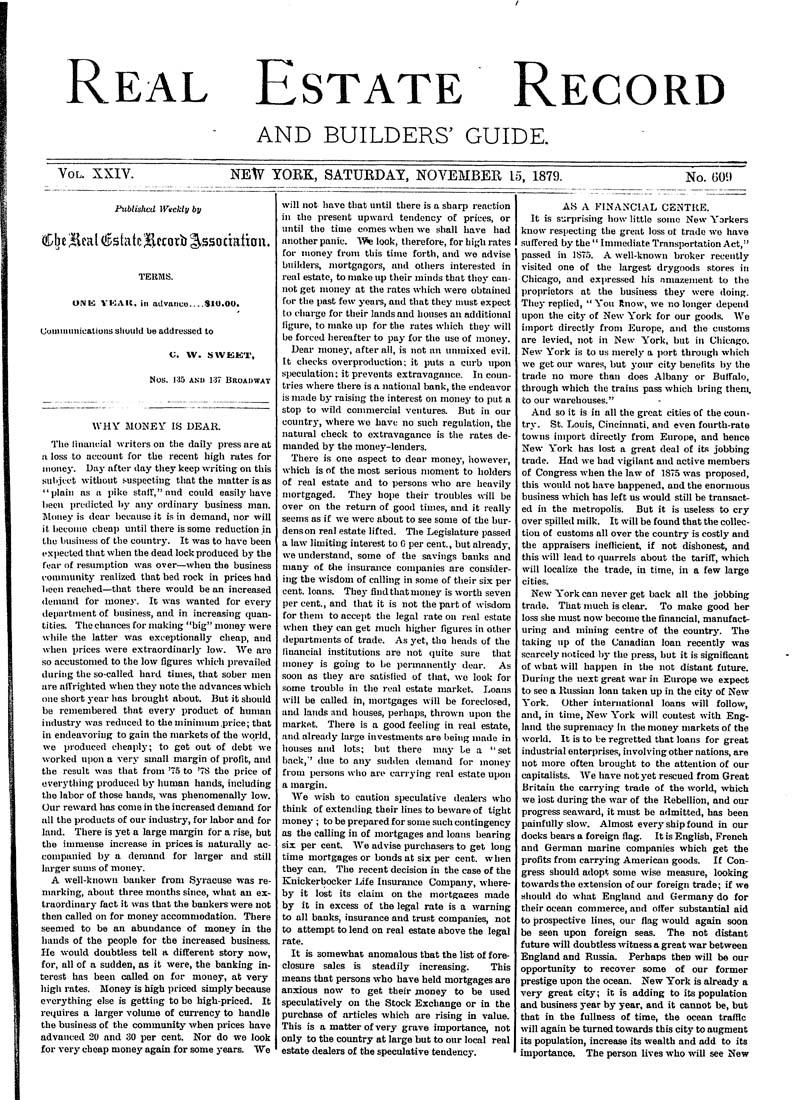

Real Estate Record AND BUILDERS' GUIDE. Vol. XXIY. NEW YORK, SATUEDAY, NOVEMBER 15, 1879. No. 609 Published Weekly by TERMS. ONK VKAK, in advance.. ..SIO.OO. Couiinunications should be addressed to C. W. SWKKT, Nos. Vib AND 137 Broahwat WHY MONEY IS DEAR. The liiuincial writers on the daily press are at a loss to account for the recent high rates for inoiiej-. Day after day they keep writing on this subject without suspecting that the matter is as "plain as a pike stall'," and could easilj'have been predicted by any ordinary business man. Money is dear becau.se it is in demand, nor will it become cheap until there is some reduction in the business of the country. It was to have been expected that when the dead lock produced by the fear of resumption was over—when the business community reali'zed that bed rock in prices had been reached—that there would be an increased demand for monej-. It was wanted for every department of business, and in increasing quan¬ tities. The chances for making "big" money were while tbe latter was exceptionally cheap, and when prices were extraordinarlj- low. We are so accustomed to the low figures which prevailed during the so-called hard times, that sober men are alTrigbted when they note the advances which one short year has brought about. But it should be remembered that every product of human industrj"- was reduced to the minimum .price; that in endeavoring to gain tho markets of the world, we produced cheaplj-; to get out of debt w-e worked upon a verj- small margin of profit, and the result was that from '7.5 to '78 the price of overj'thing produced bj' human hands, including tho labor of those hands, was phenomenally low. Our reward has come in the increased demand for all the products of our industry, for labor and for land. There is yet a large margin for a rise, but the immense increa.se in prices is naturally ac¬ companied by a demand for larger and still larger sums of money. A well-known banker from Sj'racuse was re¬ marking, about three months since, what an ex- ti-aordinary fact it was that the bankers were uot then called on for monej' accommodation. There seemed to be an abundance of money in the hands of the people for the increased business. He w-ould doubtless tell a different story now, for, all of a sudden, as it were, the banking in¬ terest has been called on for money, at very higli rates. Money is high priced simply because everything else is getting to be high-priced. It requires a larger volume of currency to handle the business of the community when prices have advanced 20 and 30 per cent. Nor do we look for very cheap money again for some j-ears. "We will not have that until there is a sharp reaction in tho present upward tendencj- of prices, or until the time comes when we shall have had another panic. Yfie look, therefore, for high rates for monej' from this time forth, and we advise builders, mortgagors, and others interested in real estate, to make up their minds that thej' can¬ not get money at the rates which were obtained for the past few yeai's, and that they must expect to cliargo for their lands and houses an additional ligure, to make u]i for the rates which they will be forced hereafter to paj- for the use of money. Dear monej', after all, is not an unmixed evil. It checks overproduction; it puts a curb upon speculation; it prevents extravagance. In coun¬ tries where there is a national bank, the endeavor is miide bj' raising the interest on monej' to put a stop to wild commercial ventures. But in our countrj-, where we have no such regulation, the natural check to extravagance is the rates de¬ manded by the monej--lenders. There is one aspect to dear monej', however, w-hich is of the most serious moment to holders of real estate and to persons who are heavily mortgaged. They hoiie their troubles will be over on the return of good times, and it reallj- seems as if we were about to see some of the bur¬ dens on real estate lifted. The Legislature passed a law limiting interest to G per cent., but already, we understand, some of the savings banks and many of tlie insurmice companies are consider¬ ing the wisdom of calling in some of their six per cent, loans. Thej' find that money is worth seven per cent., and that it is not the part of wisdom for them to accept the legal rate on real e.state w-hen they can get much higher figures in other departments of trade. As yet, tho heads of the financial institutions are not quite sure that money is going to be permanentlj- dear. As soon as they are satislied of that, we look for some trouble in the real esL-ite market. Loans will be called in, mortgages will be foreclosed, and lands tind houses, perhaps, thrown upon the market. There is a good feeling in real estate, and alreadj' large investments are being made in houses and lots; but there miij- be a "set back,' due to any sudden deinand for inonej- from persons who arc carrying real estate upon a margin. We wish to caution speculative dealei-s who think of extending their lines to beware of tight monej-; to be prepared for some such contingency as the calling in of mortgages and loans bearing six per cent. AVe advise purchasers to get long time mortgages or bonds at six per cent, when they can. The recent decision in the case of the Knickerbocker Life Insurance Company, where- bj' it lost its claim on the mortgaees made by it in excess of the legal rate is a warning to all banks, insurance and trust companies, not to attempt to lend on real estate above the legal rate. It is somewhat anomalous that the list of fore¬ closure sales is steadily increasing. This means that persons who have held mortgages are anxious now to get their money to be used speculatively on the Stock Exchange or in the purchase of articles which are rising in value. This is a matter of very grave importance, not only to the coimtry at large but to our local real estate dealers of the speculative tendencj'. AS A FINANCIAL CENTRE. It is surprising how little some Nexv Yorkers know respecting the great loss ot trade wo have .suffered bj- the " Immediate Transportation Act," passed in 1S7.~>. A well-known broker recently visited one of the largest drygoods stores iu Chicago, and expres-sed his amazement to the proprietors at the business they were doing. Thej- replied, " You Rnow, we no longer depend upon the citj' of New York for our goods. We import directly from Europe, and the customs are levied, not in New York, but in Chicago. New York is to us merelj' a jiort through which we get our wares, but j'our city benefits bj' the trade no more than does Albanj' or Buffalo, through which the trains pass which bring them, to our w-arehouses." And so it is in all the great cities of the coun¬ trj', St. Louis, Cincinnati, and even fourth-rate towns import directly from Europe, and hence New York has lost a great deal of its jobbing trade. Had we had vigilant and active members of Congress when the law- of 1875 w-as proposed, this would not have happened, and the enormous business which has left us would still be transact¬ ed in the metropolis. But it is useless to cry over spilled milk. It will be found that the collec¬ tion of customs all over the country is costlj- and the appraisers inefficient, if not dishonest, and this will lead to quarrels about the tariff, which will localize the trade, in time, in a few large cities. New York can never get back all the jobbing trade. That much is clear. To make good her loss she must now become the financial, manufact¬ uring and mining centre of the countrj'. The taking up of the Canadian loan recently was scarcely noticed bj' the press, but it is significant of what will happen in the not distant future. During the next great war in Europe we expect to see a Russian loan taken up in the citj' of New York. Other international loans will follow, and, in time, New York will contest with Eng¬ land the supremacj' In the money markets of the world. It is to be regretted that loans for great industrial enterprises, involving other nations, are not more often brought to the attention of our capitalists. We have not j-et rescued from Great Britain the carrjMng ti-ade of the world, which we lost during the war of the Rebellion, and our progress seaward, it must be admitted, has been painfullj- slow. Almost everj' ship found in our docks bears a foreign flag. It is English, French and German marine companies which get the profits from carrj'ing American goods. If Con¬ gress should adopt some wi.se measure, looking towards the extension of our foreign trade; if we should do what England and Germany do for their ocean commerce, and offer substantial aid to prospective lines, our flag w-ould again soon be seen upon foreign seas. The not distant future will doubtless witness a great war between England and Russia. Perhaps then will be our opportunity to recover some of our former prestige upon the ocean. New York is already a very great city; it is adding to its population and business year bj- year, and it cannot be, but that in the fullness of time, the ocean traffic w-ill again be turned towards this citj' to augment its population, increase its wealth and add to its importance. The person lives who will see New