Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

The Record and guide: v. 36, no. 905: July 18, 1885

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

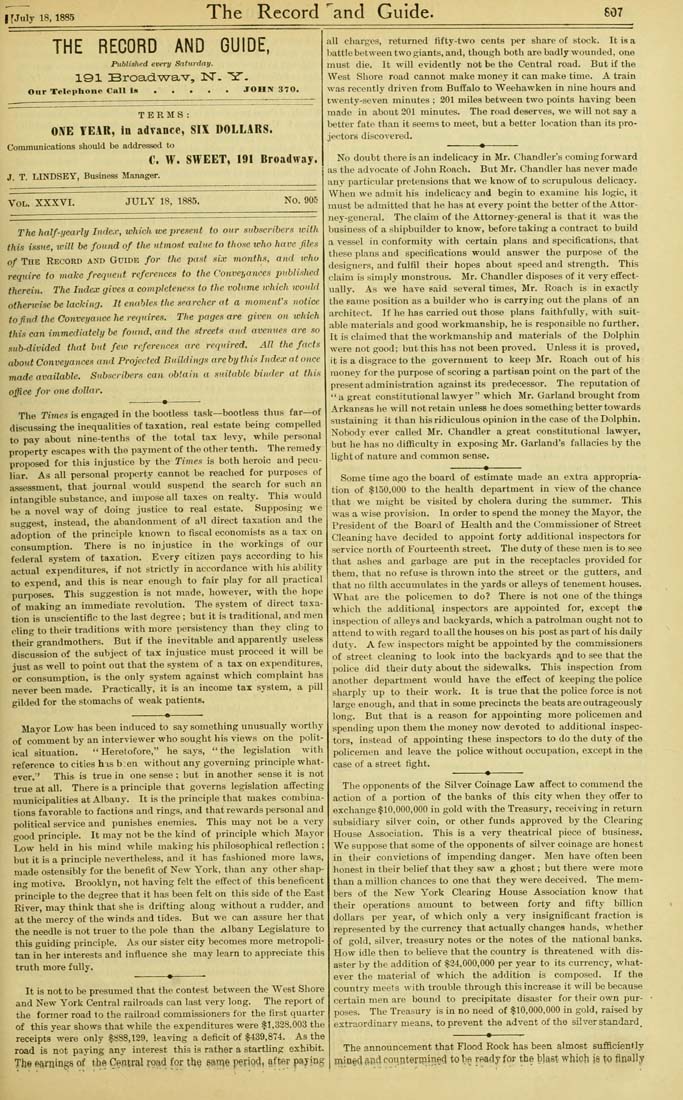

IT July 18, 1885 The Record and Guide. 807 THE RECORD AND GUIDE, Piblished every Saturday. 191 Broad.'wav, IST. "^. Our Telephone Call is.....JOHN 370. TERMS: ONE YEAR, In advance, SIX DOLLARS. Communications should be addressed to C. W. SWEET, 191 Broadway. J. T. LINDSEY, Business Manager. Vol. XXXVI. JULY 18, 1885. No. 905 The half-yearly Inde^r, which we present to our subscribers toith this issue, icill be found of the utmost value to those who have files of The Record and Guide for the pa.^t six months, and who require to make frequent references to the Conveyances published therein. The Index gives a completeness to the volume ivhich ivould otherwise be lacking. It enables the searcher at a momenVs notice to find the Conveyance he requires. The pages are given on which this can immediately be found, and the streets and avemtes are so sub-divided that but few references are required. All the facts about Conveyances ayid Projected Buildings are by this Index at once made available. Subscribers can obtain a suitable binder at this office for one dollar, .--------«--------. The Times is engaged in the bootless task—bootless thus far—of discussing the inequalities of taxation, real estate being compelled to pay about nine-tenths of the total tax levy, while personal property escapes with the payment of the other tenth. The remedy proposed for this injustice by the Times is both heroic and pecu¬ liar. As all personal property cannot be readied for purposes of assessment, that journal would suspend the search for such nn intangible substance, and impose all taxes on realty. This would be a novel way of doing justice to real estate. Supposing we suggest, instead, the abandonment of aU direct taxation and the adoption of the principle known to fiscal economists as a tax on consumption. There is no injustice in the workings of our federal system of taxation. Every citizen pays according to his actual expenditures, if not strictly in accordance with his al»ility to exi>end, and this is near enough to fair play for all practical purposes. This suggestion is not made, however, with the hope of making an immediate revolution. The system of direct taxa¬ tion is unscientific to the last degree ; but it is traditional, and men cling to their traditions with more persistency than they cling to their grandmothers. But if the inevitable and apparently useless discussion of the subject of tax injustice must proceed it will be just as well to point out that the system of a tax on expenditures, or consumption, is the only system against which complaint has never been made. Practically, it is an income tax system, a pill gilded for the stomachs of weak patients. all charges, returned fifty-two cents per share of stock. It is a battle between two giants, and, though both are badly wounded, one must die. It will evidently not be the Central road. But if the West Shore road cannot make money it can make time. A train was recently driven from Buffalo to Weehawken in nine hours and twenty-seven minutes ; 201 miles between two points having been made in about 201 minutes. The road deserves, we will not say a better fate than it seems to meet, but a better location than its pro¬ jectors discovered. --------«—.—_ No doubt there is an indelicacy in Mr, Chandler's coming forward as the advocate of John Roach. But Mr. Chandler has never made any particular pretensions that we know of to scrupulous delicacy. When we admit his indelicacy and begin to examine his logic, it must be admitted that he has at every point the better ofthe Attor¬ ney-general. The claim of the Attorney-general is that it was the business of a shipbuilder to know, before taking a contract to build a vessel in conformity with certain plans and specifications, that these plans and specifications would answer the purpose of the designers, and fulfil their hopes about speed and strength. This claim is simply monstrous. Mr. Chandler disposes of it very eflfect- tially. As we have said several times, Mr. Roach is in exactly the same position as a builder who is carrying out the plans of an architect. If he has carried out those plans faithfully, with suit¬ able materials and good workmanship, he is responsible no further. It is claimed that the workmanship and materials of the Dolphin were not good; but this has not been proved. Unless it is proved, it is a disgrace to the government to keep Mr. Roach out of his money for the purpose of scoring a partisan point on the part of the present administration against its predecessor. The reputation of " a great constitutional lawyer " which Mr. Garland brought from Arkansas he will not retain unless he does something better towards sustaining it than his ridiculous opinion in the case of the Dolphin. Nobody ever called Mr. Chandler a great constitutional lawyer, but he has no difficulty in exposing Mr. Garland's fallacies by the light of nature and common sense. Mayor Low has been induced to say something unusually worthy of comment by an interviewer who sought his views on the polit¬ ical situation. "Heretofore," he says, "the legislation with reference to cities has b en without any governing principle what¬ ever.*' This is true in one sense ; but in another sense it is not true at all. There is a principle that governs legislation affecting municipalities at Albany. It is the principle that makes combina¬ tions favorable to factions and rings, and that rewards personal and political service and punishes enemies. This may not be a very good principle. It may not be the kind of principle which Mayor Low held in his mind while making his philosophical reflection ; but it is a principle nevertheless, and it has fashioned more laws, made ostensibly for the benefit of New York, than any other shap¬ ing motive. Brooklyn, not having felt the effect of this beneficent principle to the degree that it has been felt on this side of the East River, may think that she is drifting along without a rudder, and at the mercy of the winds and tides. But we can assure her that the needle is not truer to the pole than the Albany Legislature to this guiding principle. As our sister city becomes more metropoli¬ tan in her interests and influence she may learn to appreciate this truth more fully. --------•-------• It is not to be presumed that the contest between the West Shore and New York Central railroads can last very long. The report of the former road lo the railroad commissioners for the first quarter of this year shows that while the expenditures were $1,328,003 the receipts were only $838,129, leaving a deficit of |439,874. As the road is not paying any interest this is rather a startling exhibit. The f^ftrnings of the Central ypad for tU^ fifttne P^Pq^, after paying Some time ago the board of estimate made an extra appropria¬ tion of $150,000 to the health department in view of the chance that we might be visited by cholera during the summer. This was a wise provision. In order to spend the money the Mayor, the President of the Board of Health and the Commissioner of Street Cleaning have decided to appoint forty additional inspectors for service north of Fourteenth street. The duty of these men is to see that ashes and garbage are put in the receptacles provided for them, that no refuse is thrown into the street or the gutters, and that no lilth accumulates in the yards or alleys of tenement houses. What are the policemen to do? There is not one of the things which the additional inspectors are appointed for, except the inspection of alleys and backyards, which a patrolman ought not to attend to with regard to all the houses on his post as part of his daily duty. A few inspectors might be appointed by the commissioners of street cleaning to look into the backyards fyid to see that the police did their duty about the sidewalks. This inspection from another department would have the effect of keeping the police sharply up to their work. It is true that the police force is not large enough, and that in some precincts the beats are outrageously long. But that is a reason for appointing more policemen and spending upon them the money now devoted to additional inspec¬ tors, instead of appointing these inspectors to do the duty of the policemen and leave the police without oocupation, except in the case of a street fight. --------«-------- The opponents of the Silver Coinage Law affect to commend the action of a portion of the banks of this city when they offer to exchange $10,000,000 in gold with the Treasury, receiving in return subsidiary silver coin, or other funds approved by the Clearing House Association. This is a very theatrical piece of business. We suppose that some of the opponents of silver coinage are honest in their convictions of impending danger. Men have of ten been honest in their belief that they saw a ghost; but there were more than a million chances to one that they were deceived. The mem¬ bers of the New York Clearing House Association know that their operations amount to between forty and fifty billion dollars per year, of which only a very insignificant fraction is represented by the currency that actually changes hands, whether of gold, silver, treasury notes or the notes of the national banks. How idle then to believe that the country is threatened with dis¬ aster by the addition of $24,000,000 per year to its currency, what¬ ever the material of which the addition is comi^osed. If the country meets with trouble through this increase it will be because certain men are bound to precipitate disaster for their own pur¬ poses. The Treasury is in no need of $10,000,000 in gold, raised by extraordinary means, to prevent the advent of the silver standard^ The announcement that Flood Rock has been almost sufficiently mio§(} a-nd ronnteri:nined tob§ mdy for the h]mt which is to finally