Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

The Record and guide: v. 40, no. 1011: July 30, 1887

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

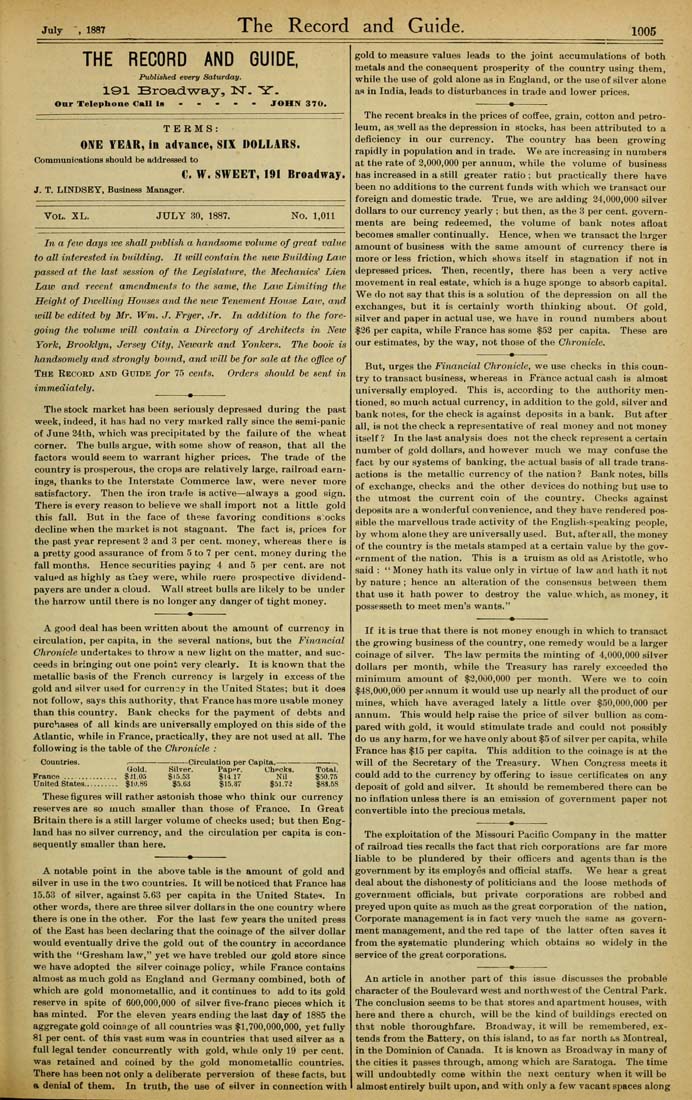

July 1887 The Record and Guide. 1006 THE RECORD AND GUIDE, Published every Saturday. 191 BroacLTAray, IST. "^T. Onr Telephone Call I0 - - - • JOHN 370. TERMS: ONE YEAR, in advance, SIX DOLLARS. Communications should be addressed to €. W. SWEET, 191 Broadway. J. T. LINDSEY, Business Manager. Vol. 2L. JULY 30. 1887. No. 1,011 l7i a feiv days we shall pjtblish a haiidsome volume of great value to all interested in building. It will eoniain the new Building Law passed at the last session of the Legislature, the Mechanics'' Lien Law and recent amendments to the same, the Law Limiting the Height of Ihvelling Houses and the new Tenement House Law, and will he edited hy Mr. Wm. J. Fryer, Jr. In addition to the fore¬ going the volume will contain a Directory of Architects in New York., Brooklyn, Jersey City, Newark and Yonkers. The hook is handsomely arid strongly hound, and unit be for sale at the office of The Record and Guide for 75 cents. Orders should be sent in immediately. Tlie stock market has been seriously depressed during the past week, indeed, it has had no very marked rally since the semi-panic of June 24th, which was precipitated by the failure of the wheat corner. The bulls argue, with some show of reason, that all the factors would seem to warrant higher prices. The trade of the country is prosperous, the crops are relatively large, railroad earn¬ ings, thanks to the Interstp-te Commerce law, were never more satisfactory. Then the iron trade is active—always a good sign. There is every reason to believe we shall import not a little gold this fall. But in the face of these favoring conditions socks decline when the market is not stagnant. The faf:t is, prices for the past year represent 2 and 3 per cent, money, whereas there is a pretty good assurance of from 5 to 7 per cent, money during the fall months. Hence securities paying 4 and 5 per cent, are not valued as highly as tbey were, while mere prospective dividend- payers are under a cloud. Wall street bulls are likely to be under the harrow until there is no longer any danger of tight money. A good deal has been written about the amount of currency in circulation, per capita, in the several nations, but the Financial Chronicle undertakes to throw a new light on the matter, and suc¬ ceeds in bringing out one point very clearly. It is known that the metallic basis of the French currency is largely in excess of the gold and silver used for currency in the United States; but it does not follow, says this authority, that France has more usable money than this country. Bank checks for the payment of debts and purchases of all kinds are universally employed on this side of the Atlantic, while in France, practically, they are not used at all. The following is the table of the Chronicle : --------Circulation per Capita.-------------------, Silver. Pap^r. Chpclts. Total. $15.53 $14,17 Nil $50.75 $5,63 $15.37 $51.7^ $88.68 Countries. Gold. France ... ........... $n.05 United States.......... $li).86 These figures will rather astonish those who think our currency reserves are so much smaller than those of Franco. In Great Britain there is a still larger volume of checks used; but then Eng¬ land has no silver currency, and the circulation per capita is con¬ sequently smaller than here. A notable point in the above table is the amount of gold and silver in use in the two countries. It will be noticed that France has 15.53 of silver, against 5.63 per capita in the United States. In other words, there are three silver dollars in the one country where there is one in the other. For the last few years the united press ol" the East has been declaring that the coinage of the silver dollar would eventually drive the gold out of the country in accordance with the **Gresham law," yet we have trebled our gold store since we have adopted the silver coinage policy, while France contains almost as much gold as England and Germany combined, both of which are gold monometallic, and it continues to add to its gold reserve in spite of 600,000,000 of silver five-franc pieces which it has minted. For the eleven years ending the last day of 1885 the aggregate gold coinage of all countries was $1,700,000,000, yet fully 81 per cent, of this vast sum was in countries that used silver as a full legal tender concurrently with gold, while only 19 per cent, was retained and coined by the gold monometallic countries. There has been not only a deliberate perversion of these facts, but ft denial of them. In truth, the use of silver in connection with gold to measure values leads to the joint accumulations of both metals and the consequent prosperity of the country using them, while the use of gold alone as in England, or the use of silver alone as in India, leads to disturbances in trade and lower prices. The recent breaks in the prices of coffee, grain, cotton and petro¬ leum, as well as the depression in stocks, has been attributed to a deficiency in our currency. The country has been growing rapidly in population and in trade. We are increasing in numbers at the rate of 3,000,000 per annum, while the volume of business has increased in a still greater ratio ; but practically there have been no additions to the current funds with which we transact our foreign and domestic trade. True, we are adding 24,000,000 silver dollars to our currency yearly ; but then, as the 3 per cent, govern¬ ments are being redeemed, the volume of bauk notes afloat becomes smaller continually. Hence, when we transact the larger amount of business with the same amount of currency there is more or less friction, which shows itself in stagnation if not in depressed prices. Then, recently, there has been a very active movement in real estate, which is a huge sponge to absorb capital. We do not say that this is a solution of the depression on all the exchanges, but it is certainly worth thinking about. Of gold, silver and paper in actual use, we have in round numbers about $26 per capita, while France has some $53 per capita. These are our estimates, by the way, not those of the Chronicle. But, urges the Financial Chronicle, we use checks in this coun¬ try to transact business, whereas in France actual cash is almost universally employed. This is, according to the authority men¬ tioned, so much actual currency, in addition to the gold, silver and bank notes, for the check is against deposits in a bank. But after all, is not the check a representative of real money and not money itself? In the last analysis does not the check represent a certain number of gold dollars, and however much we may confuse the fact by our systems of banking, the actual basis of all trade trans¬ actions is the metallic currency of the nation ? Bank notes, bills of exchange, checks and the other devices do nothing but use to the utmost the current coin of the country. Checks against deposits are a wonderful convenience, and they have rendered pos¬ sible the marvellous trade activity of the English-speaking people, by whom alone they are universally used. But, after all, the money of the country is the metals stamped at a certain value by the gov- *^rnment of the nation. This is a truism as old as Aristotle, who said : " Money hath its value only in virtue of law and Iiath it not by nature ; hence an alteration of the consensus between them that use it hath power to destroy the value which, as money, it possesseth to meet men's wants." If it is true that there is not money enough in which to transact the growing business of the country, one remedy would be a larger coinage of silver. The law permits the minting of 4,000,000 silver dollars per month, while tlie Treasury has rarely exceeded the minimum amount of $3,000,000 per month. Were we to coin $48,000,000 per jinnum it would use up nearly all the product of our mines, which have averaged lately a little over $50,000,000 per annum. This would help raise the price of silver bullion as com¬ pared with gold, it would stimulate trade and could not possibly do us any harm, for we have only about $5 of silver per capita, while France has $15 per capita. This addition to the coinage is at the will of the Secretary of the Treasury. When Congress meets it could add to the currency by offering to issue certificates on any deposit of gold and silver. It should be remembered there can be no inflation unless there is an emission of government paper not convertible into the precious metals. The exploitation of the Missouri Pacific Company in the matter of railroad ties recalls the fact that rich corporations are far more liable to be plundered by their ofl&cers and agents than is the government by its employes and official staffs. We hear a great deal about the dishonesty of politicians and the loose methods of government officials, but private corporations are robbed and preyed upon quite as much as the great corporation of the nation, Corporate management is in fact very much the same as govern¬ ment management, and the red tape of the latter often saves it from the systematic plundering which obtains so widely in the service of the great corporations. An article in another part of this issue discusses the probable character of the Boulevard west and northwest of the Central Park. The conclusion seems to be that stores and apartment houses, with here and there a church, will be the kind of buildings erected on that noble thoroughfare. Broadway, it will be remembered, ex¬ tends from the Battery, on this island, to as far north as Montreal, in the Dominion of Canada. It is known as Broadway in many of the cities it passes through, among which are Saratoga. The time will undoubtedly come within the next century when it will be almost entirely built upon» and with only a few vacant spaces along