Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

The Record and guide: v. 40, no. 1012: August 6, 1887

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

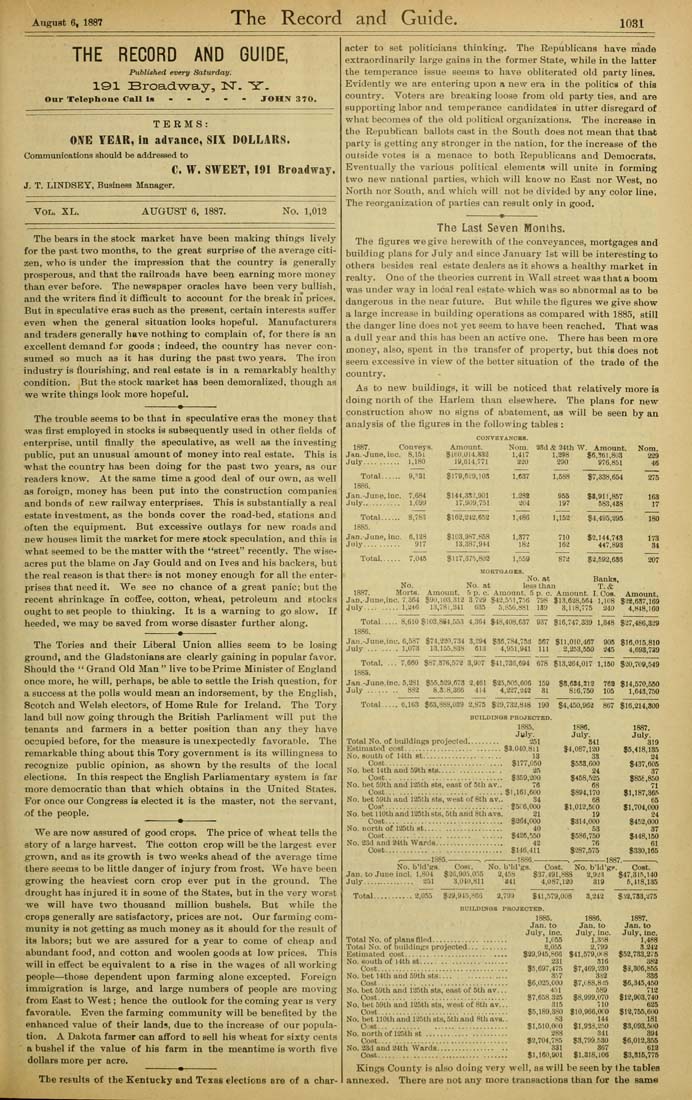

August 6, 1887 The Record and Guide. 1031 THE RECORD AND GUIDE, Published every Saturday. IQl Broad^w^ay, IST. "ST. Onr Telephoue Call Is JOHIV 370. TERMS: GIVE YEAR, in advance, SIX DOLLARS. Communications should be addressed to C. W. SWEET, 191 Broadway. J. T. LINDSEY, Business Manager. Vol. XL. AUGUST 6. 1887. No. 1,012 The bears ia the stock market have been making things lively for the pa^t two months, to the great surprise of the average citi¬ zen, who is under tbe impression that the country is generally prosperous, and that the railroads have been earning more money than ever before. The newspaper oracles have been very bullish, and the writers find it difficult to account for the break in prices. But in speculative eras such as the present, certain interests suffer even when the general situation looks hopeful. Manufacturers and traders generally have nothing to complain of, for there is an excellent demand for goods ; indeed, the country has never con¬ sumed so much as it has during the past two years. The iron industry is flourishing, and real estate is in a remarkably healthy ■condition. But the stock market has been demoralized, though as we write things look more hopeful. The trouble seems to be that in speculative eras the money that was first employed in stocks is subsequently used in other fields of enterprise, until finally the speculative, as well as the investing public, put an unusual amount of money into real estate. This is what the country has been doing for the past two years, as our readers know. At the same time a good deal of our own, as well as foreign, money has been put into the construction companies and bonds of new railway enterprises. This is substantially a real estate investment, as the bonds cover the road-bed, stations and often the equipment. But excessive outlays for new roads and new houses limit the market for mere stock speculation, and this is what seemed to be the matter with the "street" recently. The wise¬ acres put the blame on Jay Gould and on Ives and his backers, but the real reason is that there ia not money enough for all the enter¬ prises that need it. We see no chance of a great panic; but the recent shrinkage fn coffee, cotton, wheat, petroleum and stocks ought to set people to thinking. It Is a warning to go slow. If heeded, we may be saved from worse disaster further along. The Tories and their Liberal Union allies seem to be losing ground, and the Gladstonians are clearly gaining in popular favor. Should the '* Grand Old Man " live to be Prime Minister of England once more, he will, perhaps, be able to settle the Irish question, for a success at the polls would mean an indorsement, by the English, Scotch and Welsh electors, of Home Rule for Ireland, The Tory land bill now going through the British Parliament will put the tenants and farmers in a better position than any they have ocoupiftd before, for the measure is unexpectedly favorable. The remarkable thing about this Tory government is its willingness to recognize public opinion, as shown by the results of the local elections. In this respect the English Parliamentary system is far more democratic than that which obtains in the United States. For once our Congress is elected it is the master, not the servant, of the people. ---------•--------- We are now assured of good crops. The price of wheat tells the story of a large harvest. The cotton crop will be the largest ever grown, and as its growth is two weeks ahead of the average time there seems to be little danger of injury from frost. We have been growing the heaviest corn crop ever put in the ground. The drought has injured it in some of the States, but in the very worst we will have two thousand million bushels. But while the crops generally are satisfactory, prices are not. Our farming com¬ munity is not getting as much money as it should for the result of its labors; but we are assured for a year to come of cheap and abundant food, and cotton and woolen goods at low prices. This will in effect be equivalent to a rise in the wages of all working people—those dependent upon farming alone excepted. Foreign immigration is large, and large numbers of people are moving from East to West; hence the outlook for the coming year is very favorable. Even the farming community will be benefited by the enhanced value of their lands, due to the increase of our popula¬ tion. A Dakota farmer can afford to sell his wheat for sixty cents a bushel if the value of his farm in the meantime is worth five dollars more per acre. ----------------------------»■■ ■ The reeultfi of the Kentucky and Texas elections are of a char¬ acter to set politicians thinking. The Republicans have made extraordinarily large gains in the former State, while in the latter the temperance issue seems to have obliterated old party lines. Evidently we are entering upon a new era in the politics of thia country. Voters are breaking loose from old party ties, and are supporting labor and temperance candidates in utter disregard of what becomes of the old political organizations. The increase in the Republican ballots cast in the South does not mean that that party is getting any stronger in the nation, for the increase of the outside votes is a menace to both Republicans and Democrats. Eventually the various political elements will unite in forming two new national parties, which will know no East nor West, no North nor South, and which will not be divided by any color line, The reorganization of parties can result only in good. The Last Seven Months. The figures we give herewith of the conveyances, mortgages and buildiug plans for July and since January 1st will be interesting to others besides real estate dealers as it shows a healthy market in realty. One of the theories current in Wall street was that a boom was under way in local real estate^ which was so abnormal as to be dangerous in the near future. But while the figures we give show a large increase in building operations as compared with 1885, still the danger line does not yet seem to have been reached. That was a dull year and this has been an active one. There has been more money, also, spent in the transfer of property, but this does not seem excessive in view of the better situation of the trade of the country. As to new buildings, it will be noticed that relatively more is doing north of the Harlem than elsewhere. The plans for new construction show no signs of abatement, aa will be seen by an analysis of the figures in the following tables : 1887. Conveys. Jan.'June, ioc. 8.15i July.......... 1,180 Total...... 9,'-31 1886. Jan.-June, inc. 7,684 July........... i,cyit Amount. $ltO,UU.Ji33 13.(514,771 $179,(5-.'9,10.1 CONVarANCES. Nom. 1,417 220 38d & a4th W. Amount. 1.298 $6.S6I,ai3 Total...... 1885. Jan.-June, inc. July.......... Total...... 783 6.128 917 r,045 $144,3S-',901 17,909.751 $163,31^,658 S103.987.858 13.387,944 $H7,37'>,6U2 1,637 1.288 2V4 1,486 1,377 18-4 1,559 290 1,588 955 197 976.851 $7,338,654 $«,9n,857 583,488 1,152 $4,495,395 710 163 $2,144,748 447,893 873 $3,592,635 Nom. 229 46 275 163 17 180 173 34 207 MORTOAOES. No. at No. at less than Banks, T.& No. 1887. Morts. Amount. 5 p. c. Amount. 5 p. c. Amount. I. Cos. Amount Jan.-June.inc. 7 364 $9ti,l03.3I3 3.7-^9 $42,5M,7i6 798 $13,638,564 1.11)8 $.J2,687,169 July.........1,346 13,781,^1 635 5,«56.8Sl 139 3,ll8,775 340 4,848 160 Total.....8,610 $103,884,553 4,364 $48,408,637 937 $16,747,339 1,348 $37,486,329 1886. Jan.-June.inc. 6.5S7 $74,330,734 3,294 $36,784,753 567 $11,010,467 905 $16 015 810 July........1,073 13.I55.83S 613 4,951.941 111 2,253,550 345 4,693,739 Total. 1885. Jan.-June.inc. 5,281 $55,529,673 2.461 $35,505,606 159 July ........ 833 8.3 8,366 414 4.337,343 81 7,660 $87,376,572 3,907 $41,736,694 678 $13,364,017 1,150 $30,709,549 $8,634,212 763 $14,570,550 816,750 105 1,643.750 Total.....0,163 $63,'i8B,039 2.875 $^9,733,848 190 $4,450,963 867 $16,214,300 BUILDINGS PROJECTED. 1885. 1R86. 1887. July. July. July. Total No, of buildings projected......... 351 841 319 Estimated cost..........................$8.040,8il $4,087,120 $5,418,185 No. south of Hth et...............-------- 13 33 24 Coat.............................. $177,050 $583,600 $437,605 No. bet Uth and 59th sts................ 35 24 37 Cost........................... $359,300 $458,525 $85£,850 No. bet 59th and 135th sts, east of 5th av.. 76 68 71 Cost............................$1,161,600 $894,170 $1,187,365 No. bet 59tii and 135th ste, west of 8th av.. 84 68 65 Cos'................................. $5C6,000 $1,012,510 $1,704,000 No. bet noth and 135th sts, 5th and Sth avs. 31 19 34 Cost................................ $264,000 $314,000 $452,000 No. north of 125th st..................... 40 53 8T Cost........■.................... $426,550 $586,750 $448,150 No. 2:M and 24th Wards................... 43 76 61 Cost..........■.................... $146,411 $387,575 $330,165 1885.-----------. .------------18S6.- $387,575 ^ .-----------1867.------------. No. bMd'gs. CoRV. No. b'ld'gs. Cost. No. bUd'gf. Cost. Jan. to Juue incl. 1,804 $36.90.j,0.'.5 2,45y $37,491.«8S 2.9,*:^ $47,315,140 July............... 351 3,040,811 341 4,087,130 319 5,118,135 Total...........2.055 $39,945,806 3,793 $41,579,008 3.343 $VJ.783,375 BUlLiDINOS PROJECTED. 1885, Total No. of plana filed.................... Total No. of buildings projected.......... Estimated cost........................... No. south of Uth st____ ................. Cost................................... No. bet Hth and 59th sts................ Cost ................................ No. bet 59th and 135th sts, east of Sth av... Cost................................. No. bet 59tli and 125th sts, west of 8th av... Cost.................................... No. bet 110th and 125th sts, Sth aud 8th avs.. C'lSt No. northof 125th st ...'.'..*.*!.!!!'!!".."!!."! Cost................................... No. 33d and 24th Wards.................. Cost..... ........................... 1886. Jan. to Jan. to July, inc. July, inc. 1,(.55 1.3^8 8,0.S5 2.799 $39,945,H06 $41,579,0(18 231 316 $5,697,475 $7,469,230 3f.7 3:i2 $6,02.5.000 $7,1 88,8 i5 4.M 589 $7,658335 $8,999,070 315 710 $5,189.3S0 $10,966,000 H3 144 $1,510.0^10 $1.93^,3.50 288 341 $3,704,7K5 $3,799,530 831 867 $1,160,901 $1,318,106 18Sr. Jan. to July, inc. 1,488 3.243 $53,733,2i'5 383 $3,806,855 336 $6,345,450 712 $13,908,740 625 $12,755,600 181 $3,093,54)0 394 $6,012,856 613 $3,815,776 Kings County is also doing very well, as will be seen by the tables annexed. There are not any more traneactions than for the same