Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 45, no. 1148: March 15, 1890

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

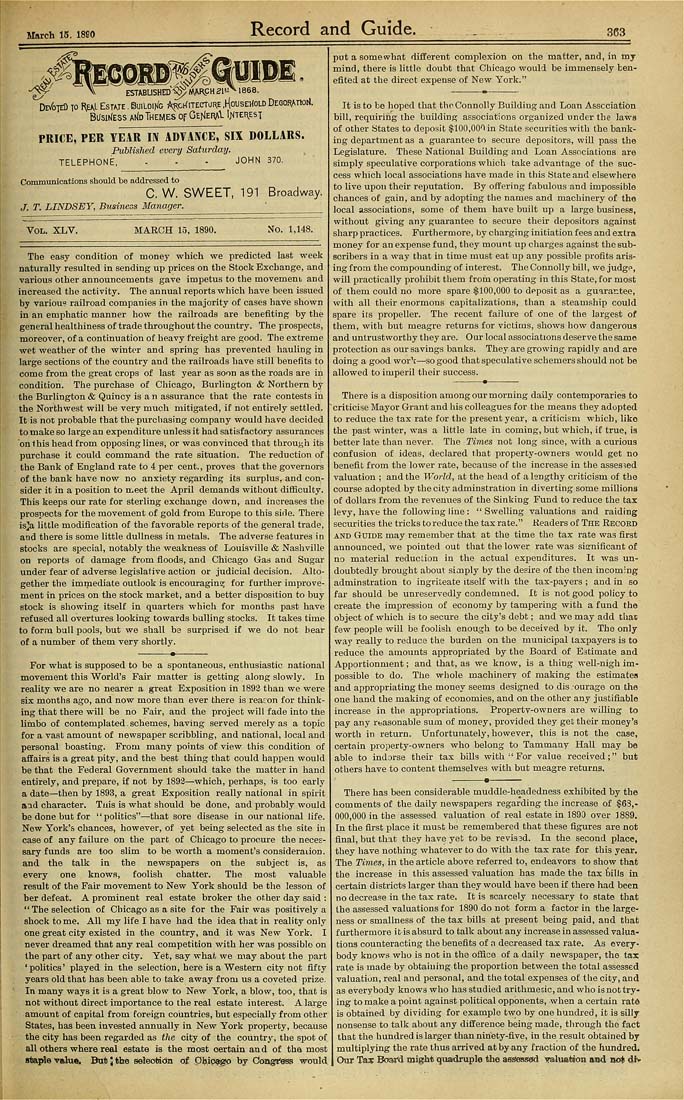

March 16. 18B0 Record and Guide. 363 De/oteD to nE\L Estate . euiLoif/c Aj!,cKiTEeTjRE .Household DEGOfihnot), Bi/sitJESS AtJoThemes of GeNera^ \^i^r\t^ PRICE, PER TEAR IN ADVANCE, SIX DOLLARS. Published every Saturday. TELEPHONE, - - - JOHN 370. Communications should be addressed to C.W. SWEET, 191 Broadway. J. T. LINDSEY, Business Manager. Vol. XLV. MARCH 15, 1890. No. 1,148- The easy condition of money which we predicted last week naturally resulted in sending up prlcea on the Stock Exchange, and various other announcements gave impetus to the movemeub and increased the activity. The annual reports which have been issued by variou"? railroad companies in the majority of cases have shown in an emphatic manner how the railroads are benefiting by the general healthiness of trade throughout the country. The prospects, moreover, of a continuation of heavy freight are good. The extreme ■wet weather of tbe winter and spring has prevented hauling in large sections of the country and the railroads have still benefits to come from the great crops of last year as soon as the roads are in condition. The purchase of Chicago, Burlington & Northern by the Burlington & Quiney is a n assurance that the rate contests in the Northwest wili be very much mitigated, if not entirely settled. It is not probable that the purcbasing company would have decided to make so large an expenditure unless it had satisfactory assurances on Ibis head from opposing lines, or was convinced that tbrouyh its purchase it could command the rate situation. The reduction of . the Bank of England rate to 4 per cent., proves that the governors of tbe bank have now no anxiety regarding its surplus, and con¬ sider it in a position to n-eet tiie April demands without difficulty. This keeps our rate for sterling exchange down, and increases the prospects for the movement of gold from Europe to this side. There is]a little modiflcation of the favorable reports of the general trade, aad there is some little dullness in metals. The adverse features in stocks are siiecial, notably the weakness of Louisville & Nashville on reports of damage from floods, and Chicago Gas and Sugar under fear of adverse legislative action or judicial decision. Alto¬ gether tbe immediate outlook is encouragins; for further improve¬ ment in prices on tbe stock market, and a better disposition to buy stock is sliowing itself in quarters which for months past have refused all overtures looking towards hulling stocks. It takes time to form bull pools, but we shall be surprised if we do not bear of a numher of them very shortly. For what is supposed to be a spontaneous, enthusiastic national movement this World's Fair matter is getting along slowly. In reality we are no nearer a gi^eat Exposition in 1893 than we were six months ago, and now more than ever there is reason for think¬ ing that there will be no Fair, and tbe project will fade into the litnbo of contemplated.schemes, having served merely as a topic for a vast amount of ne-wspaper scribbling, and national, local and personal boasting. From many points of view this condition of affairs ia a great pity, and the best thing tbat could happen would he that the Federal Government should take the matter in hand entirely, and prepare, if not by 1893—which, perhaps, is too early a date—then by 1893, a great Exposition really national in spirit and character. Tnis is what should be done, aud probably would be done hut for "politics"—that sore disease in our national life. New York's chances, however, of yet heing selected as tbe site in case of any failure on tbe part of Chicago to procure the neces¬ sary funds are too slim to be worth a moment's consideraiion, and the talk in tbe newspapers on tbe subject is, as every one knows, foolish chatter. The most valuable result of tlie Fan- movement to New York should be the lesson of her defeat. A prominent real estate broker tlie ot.her day said : " The selection of Chicago as a site for the Fair was positively a shock tome. All my life I bave had the idea tbat in reahty only one great city existed in the country, and it was New York. I never dreamed that any real competition with her was possible on the part of auy other city. Yet, say what we may about the part 'politics' played in the selection, here is a Western city not fifty years old that has beeti able to take away from us a coveted prize. In many ways it is a great blow to New York, a blow, too, that is not without direct importance to the real estate iuterest. A large amount of capital from foreign countries, hut especially from other States, has been invested annually in New York property, because the city has been regarded as the city of the country, tbe spot of all others where real estate is the most certain and of the most staple valua. But \ the eeleotsdn of Ph.iQ9^ by Coug^esg would. put a somewhat different complexion on the matter, and, in my mind, tbere is little doubt tbat Chicago would be immensely ben¬ efited at the direct expense of New York." It is to be hoped tbat the Connolly Building and Loan Asscciation bill, requiring the building associations organized under the laws of other atates to deposit $100,000 in State securities with the bank¬ ing department as a guarantee to secure depositors, will pass the Legislature. These National Building and Loan Assncialions are simply speculative corporations which take advantage of the suc¬ cess which local associations have made in this State aud elsewhere to live upou their reputation. By offering fabulous and impossible chances of gain, and by adopting the names and macbinery of the local associations, some of tbem bave built up a large business, without giving any guarantee to secure their depositoi-g against sharp practices. Furthermore, by charging initiation fees and extra money for an expense fund, they mount up charges against the sub¬ scribers in a way that in time must eat up any possible profits aris-' ingfrom the compounding of interest. The Connolly bill, we judgf>, will practically prohibit them from operating in this State, for most of them could no more spare $100,000 to deposit as a guarantee, with all their enormons capitalizations, than a steamship could spare its propeller. The recent failure of one of the largest of tbem, with but meagre returns for victims, shows how dangerous and untrustworthy they are. Our local associations deserve tbe same protection as our savings banks. They are growing rapidly and are doing a good wor't—so good that speculative schemers should not be allowed to imperil tbeir success. .__-----•-----,— There is a disposition among our morning daily contemporaries to criticise Mayor Grant and his colleagues for tbe means they adopted to reduce the tax rate for tbe present year, a criticism which, like the past winter, was a little late in coming, but wbicb, if true, is better late than never. The Times not long since, with a curious confusion of ideas, declared that property-owners would get no benefit from the lower rate, because of the increase in the assessed valuation ; and the World, at tbe head of a lengthy criticism of the course adopted by tbe city adminstration in diverting some millions of dollars from the revenues of the Sinking Fund to reduce the tax levy, have tbe following liue : " Swelling valuations and raiding securities the tricks to reduce the tax rate." Readers of The Record AND GuiDB may remember tbat at tbe time the tax rate was first announced, we pointed out that the lower rate was significant of no material reducLion in the actual expenditures. It -was un¬ doubtedly brought about siaiply by tbe desire of the then incoming adminstration to ingriteate itself with the tax-payers ; and in so far should be unreservedly condemned. It is not good policy to create tbe impression of economy by tampering with a fund tha object of which is to secure the city's debt; and we may add that few people will be foolish enough to be deceived by it. The only way really to reduce the burden on the municipal taxpayers is to reduce the amounts appropriated by tbe Board of Estimate a.nd Apportionment; and that, as we know, is a thing well-nigh im¬ possible to do. Tbe whole machinerv of making the estimates and appropriating the money seems designed to dis .ourage on the one hand the making of economies, and on the other any justifiable increase in the appropriations. Property-owners are willing to pay any rbasonable sum of money, provided they get their money's worth in return. Unfortunately, however, this is not the case, certain property-owners who belong to Tammauv Hall may be able to indorse their tax bills with ■'For value received;" but others have to content themselves with but meagre returns. There has been considerable muddle-headedness exhibited by the comments of the daily newspapers regarding the increase of $63,- 000,000 in the assessed valuation of real estate in 1890 over 1889. In tbe first place it must be remembered that these figures are not final, but that tbey have yet to be revi33d. In the second place, they have nothing whatever to do with tbe tax rate for this year. The Times, in the article above referred to, endeavors to show that the increase in this assessed valuation has made the tax feills in . certain districts larger than they would bave been if there had been no decrease in tlie tax rate. Itis scarcely necessary to state that the assessed valuations for 1890 do not form a factor in the large¬ ness or smallness of the tsix bills at present being paid, and that furthermore itis absurd to talk about any increase in assessed valua¬ tions counteracting the benefits of a decreased tax rate. As every¬ body knows who is not in the of&ce of a daily newspaper, the ta:c rate is made hy obtaining the proportion between the total assessed valuation, real and personal, and the total expenses of the city, and as everybody knows who bas studied arithmetic, and who is not try¬ ing to make a point against political opponents, when a certain rate is obtained by dividing for example two by one bundi-ed, it is silly nonsense to talk about any difference being made, through the fact that the hundred is larger than ninety-five, in the result obtained by multiplying the rate thus arrived at by any fraction of the hunda'ed. Our Tax Boai'd oaight quardmple the assessed yaluftfeioii and nofe 4*»