Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 98, no. 2541: Articles]: November 25, 1916

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

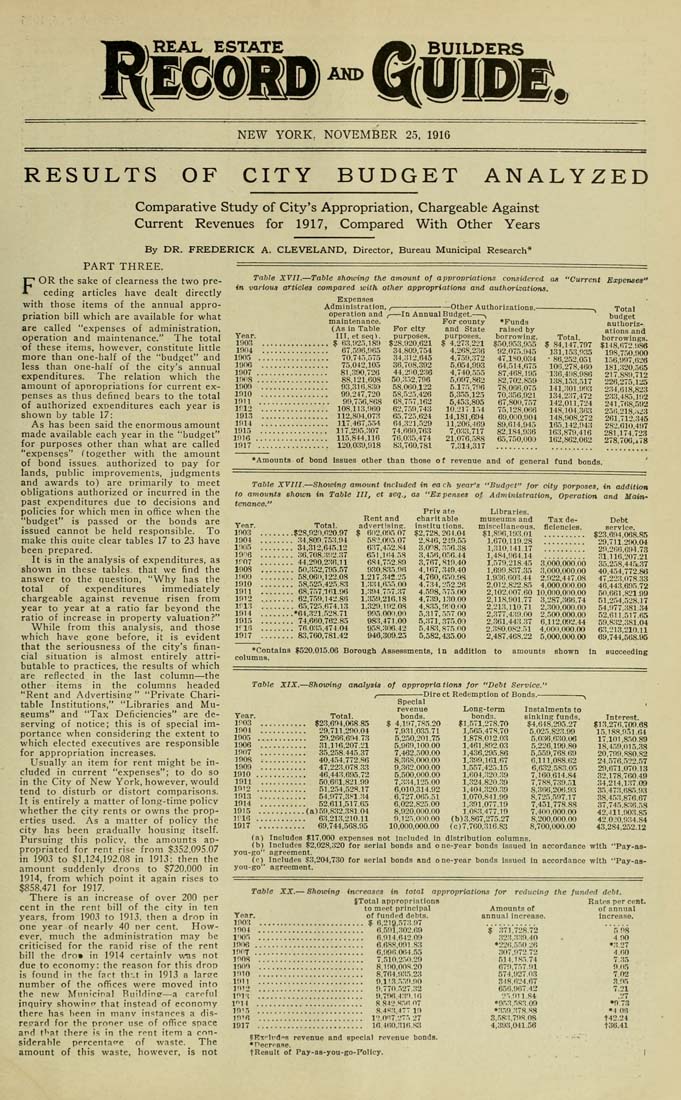

AND NEW YORK, NOVEMBER 2,5, 1916 RESULTS OF CITY BUDGET ANALYZED Comparative Study of City's Appropriation, Chargeable Against Current Revenues for 1917, Compared With Other Years By DR. FREDERICK A. CLEVELAND, Director, Bureau Municipal Research* PART THREE. FOR the sake of clearness the two pre¬ ceding articles have dealt directly with those items of the annual appro¬ priation bill which are available for what are called "expenses of administration, operation and maintenance." The total of these items, however, constitute little more than one-half of the "budget" and less than one-half of the city's annual expenditures. The relation which the amount of aporopriations for current ex¬ penses as thus defined bears to the total of authorized exoenditures each year is shown by table 17: As has been said the enormous amount made available each year in the "budget" for purposes other than what are called "expenses" ftogether with the amount of bond issues authorized to pay for lands, public improvements, judgments and awards to) are orimarily to meet obligations authorized or incurred in tlie past expenditures due to decisions and policies for which men in office when the "budget" is passed or the bonds are issued cannot be held responsible. To make this auite clear tables 17 to 23 have been prepared. It is in the analysis of expenditures, as shown in these tables, that we find the answer to the question, "Why has the total of expenditures immediately chargeable against revenue risen from year to year at a ratio far beyond the ratio of increase in property valuation?" While from this analysis, and those which have gone before, it is evident that the seriousness of the city's finan¬ cial situation is almost entirely attri¬ butable to practices, the results of which are reflected in the last column—the other items in the columns headed "Rent and Advertising" "Private Chari¬ table Institutions," "Libraries and Mu¬ seums" and "Tax Deficiencies" are de¬ serving of notice; this is of special im¬ portance when considering the extent to which elected executives are responsible for appropriation increases. Usually an item for rent might be in¬ cluded in current "expenses"; to do so in the City of New York, however, would tend to disturb or distort comparisons. It is entirely a matter of long-time policv whether the city rents or owns the prop¬ erties used. As a matter of policy the city has been gradually housing itself. Pursuing this policv, the amounts ap¬ propriated for rent rise from $352,095.07 in 1903 to $1,124,192.08 in 1913; then the amount suddenly drons to $720,000 in 1914, from which point it again rises to $858,471 for 1917. There is an increase of over 200 per cent in the rent bill of the city in ten years, from 1903 to 1913, then a drop in one year of nearly 40 ner cent. How¬ ever, much the administration may be criticised for the r.inid rise of the rent bill the dro» in 1914 certainly -m^s not due to economy: the reason for this droD is found in the fart th:.t in 1913 a laree number of the offices were moved info the new Municipal Buildine—a careful inquiry showinf that instead of economy there has been in inanv instances a dis- rejrard for the prnner use of office snace and tl'at there is in the rent item a con¬ siderable percentafe of waste. The amount of this waste, however, is not Table XVII.—Table shoioing the amount of appropriations considered aa in various articles compared with other appropriations and authcrrisations. 'Current Expenses" Year. in03 in04 im)-, 19116 1807 . 1!M18 . mof) inio mti iri2 1013 1!)14 191.5 1916 . 1917 Expenses Administration, operation and maintenance. (As in Table III, et seq). .. $ 83,92.1,189 67,.'59fi,<165 70,74.-),,575 73,042,105 81,390,726 88,121,608 93,31 (i.s:iO .. 99,247,720 99,7,56.868 .. laS,113,960 .. 112,804.07:1 .. n7,467,,554 .. 117.293,:{07 . , 11,-1,844,116 . . 120,039,918 ,—In Annual For city purposes. $28,920,621 34,809,754 34,312,645 36,708,392 44,2!l0.2:i6 50,3.-i2,796 58,01)0,122 58,525,426 68,757,162 62,7,59,743 65,725,624 64,:VJ1,.529 74,660,763 76,0;i5,474 83,760,781 -Other Authorizations.- Budget.- , For county and State purposes. $ 4,27.'!,221 4,268,2:16 4,759,:i72 5,054,993 4,740, .5,55 5,097,862 5.175,796 5,3.55,123 5,453,803 10.217 154 14,181,604 ll,20f),469 7,0:«,717 21,076,5,88 7,314,317 ♦Funds raised by borrowing, .$50,953,9,55 92,073.f(45 47,180,0,34 64.514,675 87.468,195 82,702,,85() 78,066,075 70,:!.56,921 67,800,7,57 75,128,066 69,0110,004 89,814,943 82,1,84,9;« 65,750,000 Total. $ 84,147,797 131,153.9,35 ■ 86,252.051 10(1,278,460 I:i6,4!l8,986 i:-l8,l,53,517 141,:101.993 134,237,472 142,011,724 148,104,,363 148,908,272 165.142,943 163,879,416 162,862,062 Total budget authoriz¬ ations and borrowings. $148,672,9,86 198,7.50,900 156,997,626 181,320,565 217,889,712 226,275,125 2:14.61,8.823 2.33,4,85,192 241,768,592 25li,218,:i23 261,712,.345 282,610,497 281,174,72.3 278,700,j.78 •Amounts of bond issues other than those of revenue and of general fund bonds. Table XVIII.—Showing amount included in ea to amounts shown in Table III, et acq., as "Ex tenance." ch year's "B-udget" for city porposes, in addition penses of Administration, Operation and Main- Priv Rent and charlt Year. Total. advertising. Inatitu 1903 ... .....!;2S02n620 97 $ 6112,095 07 ?2,728. 1904 ... ..... .34,809.7.5:!.94 582,095.07 2,.846, 1!)03 . . . .....34,312,645.12 637,4,52..84 3,0^8. 1016 ... ......36,708.3'.r_'.37 651,1(;458 3,4,5(!, )ro7 ... .....44,290,2.36.11 684,7,52.89 3,767, loos ... .....50,352,795.57 930„835.96 4,167, 1909 ... .....58,0611,122.08 1.217,.342.25 4,760, 1910 ... ..... 58,525.425.83 1,.33 4,6.53.00 4,734, l,:W4.7.57.:i7 4,.598, 1912 ... .....82,7.59,142.86 1,:)59,216.18 4,7.39, iri3 .,. .....65,725,674.13 1,329.192.08 4,8.33, 1914 ... .....♦64,321 ,.528.71 095 0rt'1.00 5,317, 1015 ... ..... 74,660.762.83 983,471,00 5,:i71, irifi ... ..... 76 0:H5.474.04 9.5S,.3(16.42 5,4,8:?, 1917 ... .....83,760,781.42 940,309.25 5,582, ate able tions, 261.04 219.55 3.56.38 056.44 819.40 .349.40 659.98 252.26 573.00 1.30 00 Ot'O.OO .557.00 375.00 875 00 435.00 Libraries, museums and miseellaupous. $1,896,193.01 1,670,119.28 1,310,141.17 1,4.84,964.14 1,579,218.45 1.699.8,37.33 1,936.603.44 2,012.,822.85 2,102.007.60 2,118,901.77 2,213,110.71 2,377,4:19.00 2,361,443.:J7 2.380.082.31 2,487.468.22 Tax de¬ ficiencies. 3,000, 3,000, 2 9**2 4,000! 10,0110, 3,287, 2.300, 2„50O, 6,112 4,000, 5,000, 1,000.00 ,000.00 447.08 0110.00 ono.oo ,366.74 000.00 ,000.00 ,092.44 000.00 ,000.00 Debt service. $23,694,068,85 29,711.2! 10.04 29,286,694.73 .31,116,207,21 35,2,58,44ri,,37 40,454,772,86 47,223,078.33 46,443,695.72 50,661,821 99 51,254,528.17 54,977,:1S1.;M 52,611,517.65 59,832,381.04 63,213,210.11 69,744.568.95 •Contains $520,015.06 Borough Assessments, columns. In addition to amounts shown in succeeding Table XIX.—Showing analysis of appropria Dire Year, Total 1903 ........... $23,694,068 1904 1903 1906 1907 1908 1909 1910 1911 29,711,290, 29,266,6tM 31,116,207 35,258.445 40,4,54.772 47,223.078 46,443.695 50,661,821 85 04 73 21 .37 86 33 .99 1912 ............ 51,254,528.17 1913 ........... 54.977,3S1 .34 1914 ........... 52,611,517.85 1915 ...........(a)59,8:«,381 04 1!10 ............ 63,213,210.11 1917 ........... 69,744,568.95 Special revenue bonds. $ 4,197,7.85.20 7,931,0.35.71 5,2.50,201,75 5,969,100.00 7,462„500.00 8,368,000.00 9,362,000.00 5,500,000.00 7,:«4,125.00 6,010,314.92 6,727,065.51 6,022,823.00 8,920,000.00 9,125,0110.00 10,000,000,00 tions for "Debt Service.' ct Redemption of Bonds,— Long-term bonds. $1,571,278,70 1,565,478,70 1,878,012.03 1,461,892.03 1,436,295.86 1,.399,161.67 1,557,425.15 l,604,.32n.:ra 1,324,820..39 l,4O4.,320.3g 1,070,841.99 1,.391,077.19 1.0,8:1,477.19 (b)3,Se7,275.27 (0)7,760,316.83 Instalments to sinking funds. $4,618,295.27 5.023,823,99 6,0.36,630.06 5,226,199.80 5,559,768.69 6,111,088.62 6,632.583.05 7,160.614.84 7,7.88,739.31 8,3(ie,206.93 8,723,.597,17 7,451,778.88 7,400,000.00 8,200,000.00 8,700,000,00 Interest. $13,276,709.63 15,188,9.'J1.64 17,101,8.50 89 18,4,59,015.38 20,799.880,82 24.576,522.57 29,671,070.13 32,178,760.49 34,214,i:i7.09 33.473,683.93 .38,453,876.67 37,745.8:!6..5S 42.411,903,85 42.020,9:14.84 43,284,252,12 (a) Includes $17,000 expenses not included in distribution columns, (b) Includes $2,028,320 for serial bonds and one-year bonds Issued in accordance with "Pay-as- you-go" agreement. (c) Includes $3,204,730 for serial bonds and one-year bonds issued in accordance with "Pay-as- you-go" agreement. Table XX.— Shoimng Increases in total appropriations for reducing the funded debt. Rates per cent, of annual Increase. gTotal appropriations to meet principal Year. of funded debts, 1003 ......................... $ 6,219,373.97 1904 l'K)5 ]9I)6 19(7 1908 1900 1910 1911 I'll-' 1913 l"lt 19'5 1916 1917 6,219,373.97 6,ii9l,:l02.69 6,914,642.09 6.688,091 ..S3 6,996.064.55 7,510,2.50.29 8,190,008.20 8,764.9:!5.23 9,1'3.,5,59.90 9.770.327.,32 il,796.4:l'1.16 8 842 856 07 S.4«3.4T7 in 12.0'!7.2T5 27 10.460,316.83 Amounts of annual Increaso. $ :171. ,728.72 323, :W9,40 •226 550,26 307, ,972.72 514.185,74 679, 757.91 574, 927.03 348,624.67 656, 967.42 ■'" ' 911.84 •953 583.00 •:i.59. .378.88 3,.5S3, 798.08 4,393,041,56 5 98 490 •3.27 4.60 7.:i5 9.05 7.02 3.95 7,21 ,27 •9 73 •4 08 t42.24 t3«.41 5RT"1vd"s revenue and special revenue bonds. •Pccrcase. tResuIt of Pay-as-you-go-Policy.