Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 100, no. 2581: Articles]: September 1, 1917

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

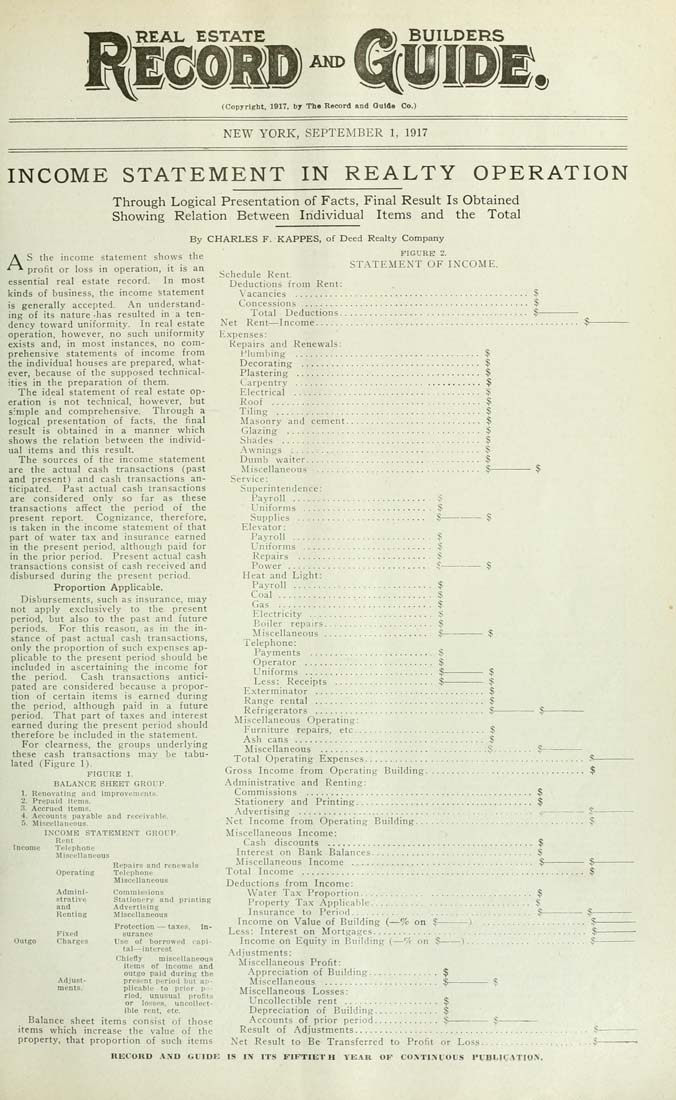

REAL ESTATE AND (Copyright. 1917, by The Record and Guide Co.) NEW YORK, SEPTEMBER 1, 1917 INCOME STATEMENT IN REALTY OPERATION Through Logical Presentation of Facts, Final Result Is Obtained Showing Relation Between Individual Items and the Total AS the income statement shows the profit or loss in operation, it is an essential real estate record. In most kinds of business, the income statement is generally accepted. An understand¬ ing of its nature -has resulted in a ten¬ dency toward uniformity. In real estate operation, however, no such uniformity exists and, in most instances, no com¬ prehensive statements of income from the individual houses are prepared, what¬ ever, because of the supposed technical¬ ities in the preparation of them. The ideal statement of real estate op¬ eration is not technical, however, but simple and comprehensive. Through a logical presentation of facts, the final result is obtained in a manner which shows the relation between the individ¬ ual items and this result. The sources of the income statement are the actual cash transactions {past and present) and cash transactions an¬ ticipated. Past actual cash transactions are considered only so far as these transactions affect the period of the present report. Cognizance, therefore, is taken in the income statement of that part of water tax and insurance earned in the present period, although paid for in the prior period. Present actual cash transactions consist of cash received and disbursed during the present period. Proportion Applicable. Disbursements, such as insurance, may not apply exclusively to the present period, but also to the past and future periods. For this reason, as in the in¬ stance of past actual cash transactions, only the proportion of such expenses ap¬ plicable to the present period should be included in ascertaining the income for the period. Cash transactions antici¬ pated are considered because a propor¬ tion of certain items is earned during the period, although paid in a future period. That part of taxes and interest earned during the present period should therefore be included in the statement. For clearness, the groups underlying these cash transactions may be tabu¬ lated (Figure 1). FIGURE 1. BALANCE SHEET GROUP. 1. Renovating and improvements. 2. Prepaid items. 3. Accrued items. 4. Accounts payable and receivable. 5. Miscellaneous. L\COME STATEMENT GROUP. Rent Income Telephone Miscellaneous Repairs and renewals Operating Telephone Miscellaneous Admini¬ strative and Renting Commissions Stationery and Advertising Miscellaneous printing Fixed Charges Adjust¬ ments. By CHARLES F. KAPPES, of Deed Realty Company FIGURE 2. STATEMENT OF INCOME. Schedule Rent. Deductions from Rent: Vacancies .......................................... Concessions ........................................ Total Deductions................................. Net Rent—Income...................................... Expenses: Repairs and Renewals: Flumliing ..................................... $ Decorating .................................... $ Plastering ..................................... $ Carpentry ..................................... $ Electrical ................................. Roof ...................................... Tiling ..................................... Masonry and cement....................... Glazing ................................... Shades ........................................ $ Awnings ...................................... $ Duinb waiter................................... $ Miscellaneous ................................. $- Service: Superintendence: Payroll ............................ $ Uniforms .......................... $ Supplies .......................... $-------------$ Elevator: ■ taxes, in- capi- Protection ■ surance Outgo Charges Use of borrowed tal—interest Chiefly miscellaneous items of income and outgo paid during the present period but ap¬ plicable to prior p - riod, unusual profits or losses, uncollect¬ ible rent. etc. Balance sheet items consist of those items which increase the value of the property, that proportion of such iteins Payroll ............................ $ Uniforms .......................... $ Repairs ........................... $ Power............................. $-------------$ Heat and Light: Payroll ............................ $ Coal ............................... $ Gas ............................... $ Electricity ......................... $ Boiler repairs...................... $ ^liscellaneous...................... $-------------$ Telephone: Payments ......................... $ Operator .......................... $ Uniforms .......................... $------------- $ Less: Receipts .................... $------------- ^ Exterminator .................................. $ Range rental .................................. $ Refrigerators .................................. $----------— $- ^Miscellaneous Operating: Furniture repairs, etc.......................... $ Ash cans ...................................... $ Miscellaneous .................................$........ $- Total Operating Expenses..................................... Gross Income from Operating Building......................... Administrative and Renting: Commissions .............................................. $ Stationery and Printing.................................... $ Advertising............................................- Net Income from Operating Building........................... Miscellaneous Income: Cash discounts .......................................... $ Interest on Bank Balances................................. $ Miscellaneous Income ..................................... $- Total Income .................................................. Deductions from Income: Water Tax Proportion.................................. $ Property Tax Applicable................................ $ Insurance to Period................................ $- Income on Value of Building (—% on $----------) ............. Less: Interest on Mortgages................................. Income on Equity in Building (—'/r on $------)............... Adjustments: Miscellaneous Profit: Appreciation of Building. . $- $-' Miscellaneous ....................... $- Miscellaneous Losses: Uncollectible rent ................... $ Depreciation of Building............. $ Accounts of prior period............. $- Result of Adjustments.................... Net Result to Be Transferred to Profit or Loss. RECORD AND GUIDE IS IN ITS FIFTIETH YEAR OF CONTI.WOUS PUBLICATION.