Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 101, no. 2611: Articles]: [March 30, 1918]

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

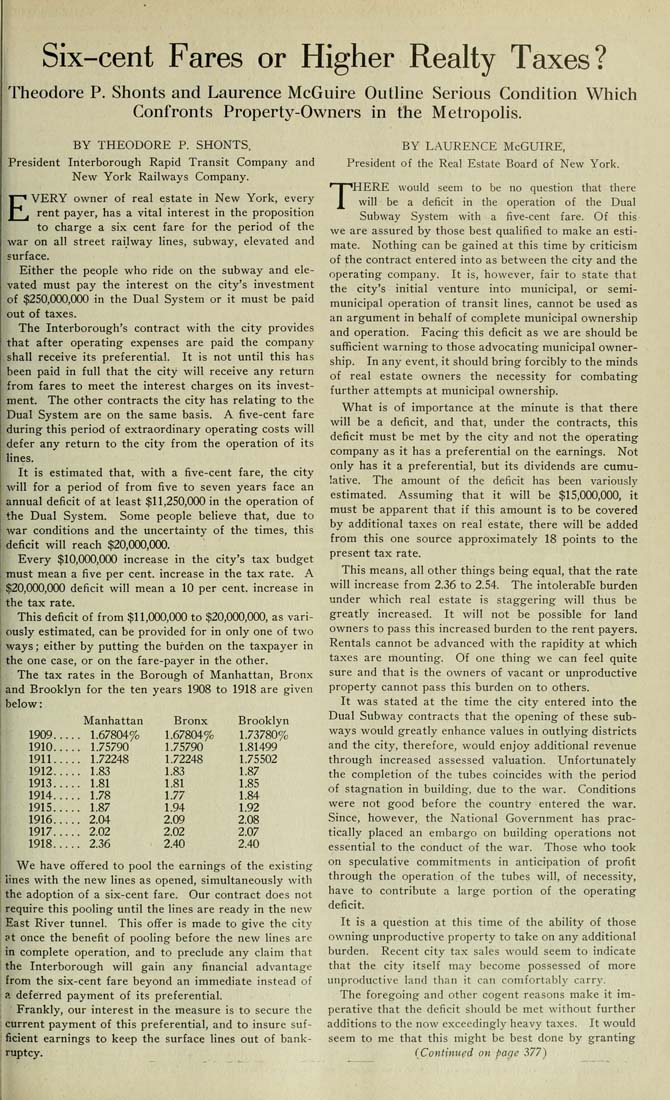

Six-cent Fares or Higher Realty Taxes? Theodore P. Shonts and Laurence McGuh-e OutUne Serious Condition Which Confronts Property-Owners in the Metropolis. BY THEODORE P. SHONTS, President Interborough Rapid Transit Company and New York Railways Company. EVERY owner of real estate in New York, every rent payer, has a vital interest in the proposition to charge a six cent fare for the period of the war on all street railway lines, subway, elevated and surface. Either the people who ride on the subway and ele¬ vated must pay the interest on the city's investment of $250,000,000 in the Dual System or it must be paid out of taxes. The Interborough's contract with the city provides that after operating expenses are paid the company shall receive its preferential. It is not until this has been paid in full that the city will receive any return from fares to meet the interest charges on its invest¬ ment. The other contracts the city has relating to the Dual System are on the same basis. A five-cent fare during this period of extraordinary operating costs will defer any return to the city from the operation of its lines. It is estimated that, with a five-cent fare, the city will for a period of from five to seven years face an annual deficit of at least $11,250,000 in the operation of the Dual System. Some people believe that, due to i war conditions and the uncertainty of the times, this deficit will reach $20,000,000. Every $10,000,000 increase in the city's tax budget i must mean a five per cent, increase in the tax rate. A $20,000,000 deficit will mean a 10 per cent, increase in the tax rate. This deficit of from $11,000,000 to $20,000,000, as vari¬ ously estimated, can be provided for in only one of two ways; either by putting the burden on the taxpayer in the one case, or on the fare-payer in the other. The tax rates in the Borough of Manhattan, Bronx . and Brooklyn for the ten years 1908 to 1918 are given below: Manhattan Bronx Brooklyn 1909..... 1.67804% 1.67804% 1.73780% 1910..... 1.75790 1.75790 1.81499 1911..... 1.72248 1.72248 1.75502 1912..... 1.83 1.83 1.87 1913..... 1.81 1.81 1.85 1914..... 1.78 1.77 1.84 1915..... 1.87 1.94 1.92 1916..... 2.04 2.09 2.08 1917..... 2.02 2.02 2.07 1918..... 2.36 ■ 2.40 2.40 We have offered to pool the earnings of the existing lines with the new lines as opened, simultaneously with the adoption of a six-cent fare. Our contract does not require this pooling until the Hnes are ready in the new East River tunnel. This offer is made to give the city 9t once the benefit of pooling before the new lines are in complete operation, and to preclude any claim that the Interborough will gain any financial advantage from the six-cent fare beyond an immediate instead of a deferred payment of its preferential. Frankly, our interest in the measure is to secure the current payment of this preferential, and to insure suf¬ ficient earnings to keep the surface lines out of bank¬ ruptcy. BY LAURENCE McGUIRE, President of the Real Estate Board of New York. THERE would seem to be no question that there will be a deficit in the operation of the Dual Subway System with a five-cent fare. Of this' we are assured by those best qualified to make an esti¬ mate. Nothing can be gained at this time by criticism of the contract entered into as between the city and the operating company. It is, however, fair to state that the city's initial venture into municipal, or semi- municipal operation of transit lines, cannot be used as an argument in behalf of complete municipal ownership and operation. Facing this deficit as we are should be sufficient warning to those advocating municipal owner¬ ship. In any event, it should bring forcibly to the minds of real estate owners the necessity for combating further attempts at municipal ownership. What is of importance at the minute is that there will be a deficit, and that, under the contracts, this deficit must be met by the city and not the operating company as it has a preferential on the earnings. Not only has it a preferential, but its dividends are cumu¬ lative. The amount of the deficit has been variously estimated. Assuming that it will be $15,000,000, it must be apparent that if this amount is to be covered by additional taxes on real estate, there will be added from this one source approximately 18 points to the present tax rate. This means, all other things being equal, that the rate will increase from 2.36 to 2.54. The intolerable burden under which real estate is staggering will thus be greatly increased. It will not be possible for land owners to pass this increased burden to the rent payers. Rentals cannot be advanced with the rapidity at which taxes are mounting. Of one thing we can feel quite sure and that is the owners of vacant or unproductive property cannot pass this burden on to others. It was stated at the time the city entered into the Dual Subway contracts that the opening of these sub¬ ways would greatly enhance values in outlying districts and the city, therefore, would enjoy additional revenue through increased assessed valuation. Unfortunately the completion of the tubes coincides with the period of stagnation in building, due to the war. Conditions were not good before the country entered the war. Since, however, the National Government has prac¬ tically placed an embargo on building operations not essential to the conduct of the war. Those who took on speculative commitments in anticipation of profit through the operation of the tubes will, of necessity, have to contribute a large portion of the operating deficit. It is a question at this time of the ability of those owning unproductive property to take on any additional burden. Recent city tax sales would seem to indicate that the city itself may become possessed of more unproductive land than it can comfortably carry. The foregoing and other cogent reasons make it im¬ perative that the deficit should be met without further additions to the now exceedingly heavy taxes. It would seem to me that this might be best done by granting {Continued on page 377)